Borrow 200k mortgage

To be able to borrow a 200k mortgage youll require an income of 61525 per year. I have 13 years left on my mortgage and just over 200k remaining to pay.

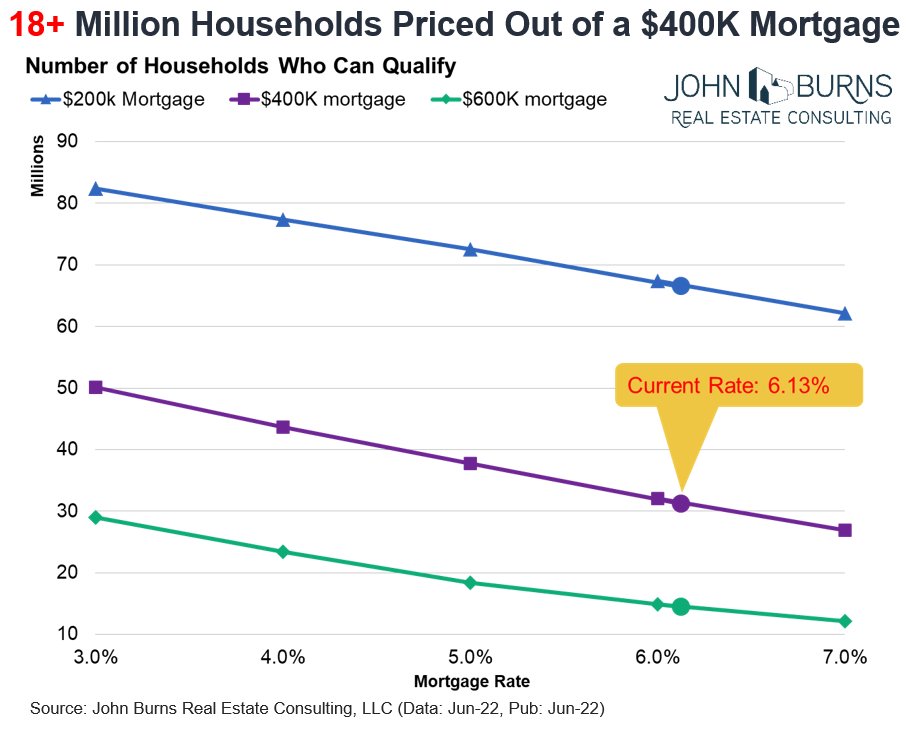

How To Hedge Falling Housing Prices

100k to 200K per year.

. Yes you heard me rightJoe Biden and ReverendWarnock are spending 15 billion on urban forestry and raising taxes on those making under 200k to pay for it. Just fill in the various fields with the information requested. Earning requirements for a 300k mortgage.

To afford a 200K mortgage with a 20 down payment 30-year term and 4 interest rate youd need to make at least 38268 a year before taxes. How much mortgage can you borrow on your salary. Short-term business loans are lump-sum loans that are designed to be paid back in less than 18 months.

My home has been valued at 550k to 600k. Using the Mortgage Qualifying Calculator. Why is everyone worried about 10K or 20K in studentloanforgiveness when changes to income based repayment plans will allow most grad students to borrow 138K and have over 100K of that debt forgiven plus 100 of the interest.

For example first-time buyers who have been affording rents far in excess of actual mortgage payments but have failed. Earnings needed for 350k. As far as down payment is concerned the more you invest the better it will be for you in the long run as this.

ICB Solutions a division of Neighbors Bank. If your DTI is under 10 for example youre likely to be. You can buy a 220k house with a 20k down payment and a 200k mortgage.

Yes I have a problem with that. They can be a flexible financial tool best used for financing short-term needsincluding managing cash flow dealing with unexpected needs for extra cash bridging larger financing options paying off expensive debt or taking advantage of unforeseen business opportunities. There are some lenders that dont rely on income multiples to determine what you can borrow and online mortgage calculators are therefore unable to reflect what they may be able to lend.

I have been offered a rate of 364 for either two or five years. New mortgage deals are at their LOWEST EVER rates with two-year fixes down to 095 and five-year fixes at 117 though in some cases they load the cost in the form of hefty fees. Say your current property is worth 200k with 150k mortgage against it.

Looking for home mortgage rates in Georgia. Whether youre looking to save money on your mortgage buy a property renovate your kitchen or purchase a new car theres an online lender to suit. 37500 per year.

To borrow more than this you will need to use a mortgage broker to access specialist lenders. Earnings needed for a 250k mortgage. You can borrow between 2000 and 75000 at a simple fixed interest rate that can be repaid weekly fortnightly or monthly over 1 to 7 years.

Earning requirements for a 200k mortgage. Jeff Rose CFP is a Certified Financial Planner founder of Good Financial Cents and author of the personal finance book Soldier of FinanceHe was a financial planner for 16 years having founded Alliance Wealth Management a SEC Registered Investment Advisory firm before selling it to focus on his passion - educating the masses on the importance of. The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory.

Here are the lowest and highest annual incomes that qualify for a 200K loan using mainstream criteria for a 30-year fixed-rate mortgage. Federal budget deficits and tuition will soar. The table below shows example calculations for maximum borrowing based on salaries between 100000 and 200000 per year.

They use a ratio of debt-to-income DTI ratio to understand how much more debt you can afford. Mark Harris chief executive of mortgage broker SPF Private Clients said. That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000.

On a 12000 car loan that would be between 1200 and 2400. Ready to get a mortgage. Calculate required income for a specific loan amount for a Mortgage Refinance or Home Purchase.

The Chatsworth California-based lender offers a 10-minute online application and often closes in as little as 28 days. Weve lots more guides tools tips to help Mortgage Best Buys speedily finds your top mortgage deals First time buyers guide free pdf guide helps you take your first step onto the property ladder Remortgage guide our free pdf guide has tips on when remortgagings right plus how to grab top deals. As a general rule your mortgage payment shouldnt exceed one-third of your monthly income.

Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately. How much you ultimately can afford depends on your down payment loan terms taxes and insurance. This is based on 45 times your household income the standard calculation used by the majority of mortgage providers.

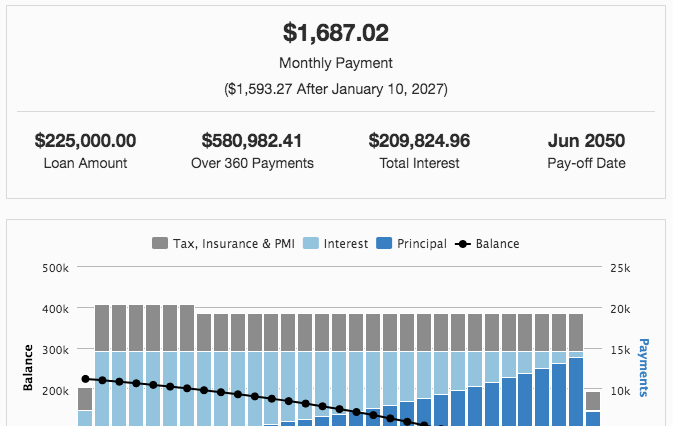

Cake Mortgage has funded over 35 billion in loans since its founding in 2018. If the property you want to buy is more expensive than your current one any additional money that you need to borrow is likely to be at a different rate. The monthly payment on a 200k mortgage is 1348.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income. When you own your own home generally you can borrow up to 80 of the appraised value. This may mean that in effect you have two mortgagesproducts with different rates and different end dates.

Earnings needed for a 250k mortgage. This entry is Required. If your home is worth 400K and you owe 200K as an example there may be 120K cash that we can extract to help with your down payment 80 of 400 is 320 less the 200 you owe leaves 120K of potential incremental borrowing.

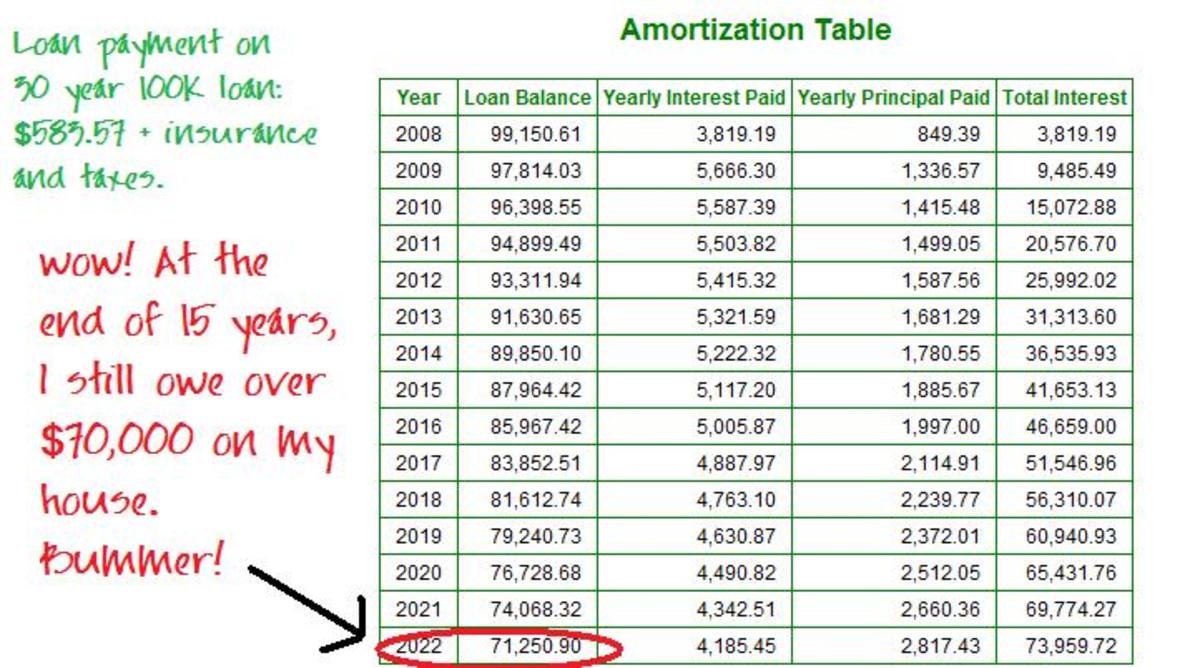

Enter an amount between 0 and 250000000. Make 21 Best Money Making Apps That Actually Work in 2023. This Mortgage Qualifying Calculator also summarizes all your information in a detailed report including an amortization table for easy reference.

Original or expected balance for your mortgage. A better question to ask is. A typical down payment is usually between 10 and 20 of the total price.

What do you do. When you apply for a loan lenders want to know if you have enough income to support your debt obligationsexisting and new. That means huge savings are possible for some.

You can access funds within 1 working day. Not affiliated or endorsed by any govt. How much money can you borrow.

Earning requirements for a 300k mortgage. Earning requirements for a 200k mortgage. How much can I borrow.

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake

How We Paid Off Our Mortgage In 5 Years Marriage Kids Money

How Much House Can I Afford Bhhs Fox Roach

Investing 200k In Real Estate Goodegg Investments

Mortgage Amortization Calculator Crown Org

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

How Much House Can I Afford How The Math Works And Rule Of Thumb

Mortgage For 100k Hot Sale 60 Off Lavarockrestaurant Com

What Are The Repayments On A 200k Mortgage Mortgageable

Mortgage Required Income Calculator Capital Bank

How Much A 200 000 Mortgage Will Cost You

What A 200 000 Mortgage Will Cost You Credit Com

Mortgage Rates Are At Record Lows Here S What That Means For You Zillowgroup

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

How Much A 200 000 Mortgage Will Cost You

High Loan To Income Mortgages New Home Loans Could Give Borrowers An Extra 200k Evening Standard

What Are The Repayments On A 200k Mortgage Yescando